The tax industry, state tax agencies and the IRS are warning taxpayers about a new scam that criminals are using to try to trick people into disclosing their bank account information in order to receive an Economic Impact Payment, or as it’s commonly referred to, a stimulus check.

What’s the Scam?

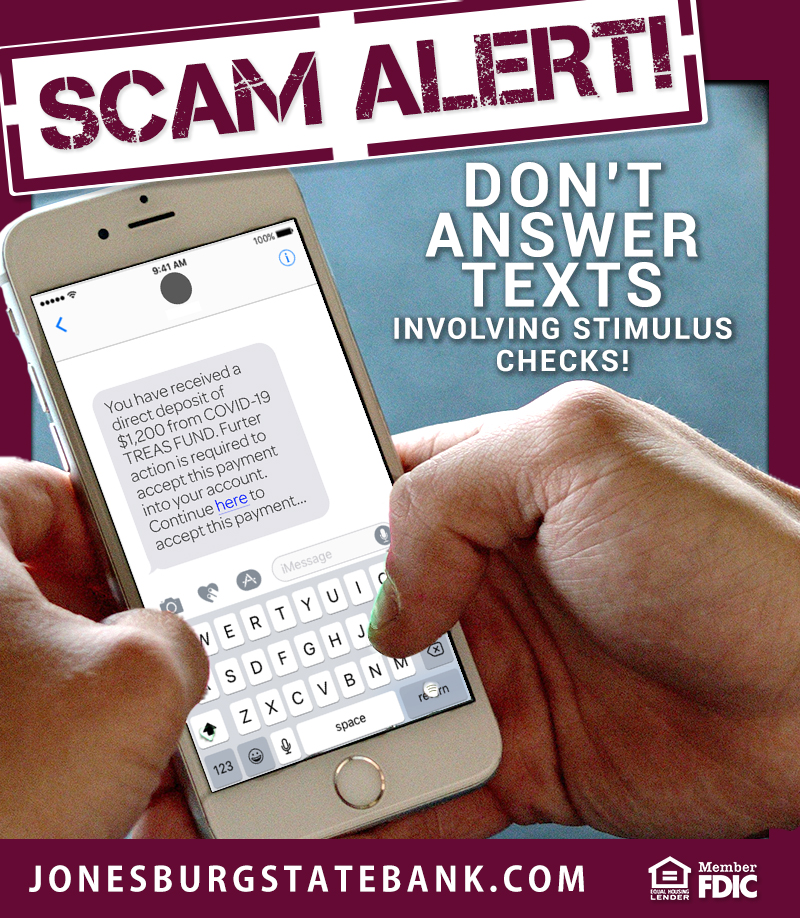

In this new scam, criminals are texting individuals with a message reading:

“You have received a direct deposit of $1,200 from COVID-19 TREAS FUND. Further action is required to accept this payment into your account. Continue here to accept this payment …”

The message includes a link that directs victims to a fraudulent website that impersonates the IRS’ Get My Payment web page. From there, the fraudulent website prompts victims to enter both their personal and banking information in order to receive the stimulus check or direct deposit, granting the scammers access to such information.

What Should I Do if I Receive This Text?

If you receive a text similar to the one described above, do not click the link or provide any personal or financial information. The IRS and state tax agencies will never text you asking for bank account information or to discuss stimulus check deposits.

The IRS is asking those who receive this text scam to take a screenshot of the text message and email it to phishing@irs.gov with the following information included in the email:

- Date, time and time zone that they received the text message

- The number that appeared on their caller ID

- The number that received the text message

By providing this information to the IRS, you can help them track this scam and protect others.